Ct Revenue Services Refund

The Department of Revenue Services DRS will provide information in writing concerning your refund. Learn what CT is doing to keep your refund out of the hands of identity thieves.

Where S My Refund Home Facebook

The Connecticut Department of Revenue Services DRS offers a variety of fast and convenient taxpayer service options.

Ct revenue services refund. Our fax number is 860-541-2486. Using Back Button of the browser that is not understood by the CT Taxpayer Service Center application. File an Extension.

Department of Revenue Services. Monday through Friday 830 am. Refund Protection Program Abstract.

Beginning 91 online filing and payments through the TSC will be disabled for Phase 2 tax types. 12-39s b provides that if the Commissioner of Revenue Services determines that any tax penalty or interest has been paid more than once or has been erroneously or illegally collected or computed the Commissioner may either credit the amount against. The program will curb identity theft and fraudulent tax refunds.

FilePay Form CT-472 Attorney Occupational Tax Return. Make an Estimated Payment. - Learn more about myconneCT.

Did you receive a Refund Protection Notice from CT Revenue Services. FilePay Form CT-1041 Income Tax Return for Trusts and Estates. Refund Protection Program The Department of Revenue Services DRS is committed to protecting taxpayers from identity theft and fraud.

What can cause a delay in my Connecticut. Our mailing address is Department of Revenue Services Fraud Unit 450 Columbus Blvd Suite 1 Hartford CT 06103. Either your session has timed-out or you have performed a navigation operation Ex.

The program will further curb identity theft and fraudule. Make a Bill Payment. 860-297-5962 Home CTgov Home Submit Tax Questions Send Feedback Login Register.

SSL 450 Columbus Blvd Suite 1 Hartford CT 06103 Phone. Thank you for your patience. Generally it takes 10 to 12 weeks to process paper returns and a shorter time to process e-filed returns.

Mailed correspondence is also taking longer to process. Refund Protection Program The Department of Revenue Services DRS is committed to protecting taxpayers from identity theft and fraud. Copy of the Refund Protection or Verification Notice contact information a copy of a state issued ID and recent W2s.

Welcome Welcome to the Connecticut Department of Revenue Services DRS Taxpayer Service Center TSC. Check on the Status of Your Refund. Expect delays if you mailed a paper return had to respond to an IRS inquiry about your e.

Connecticut Department of Revenue Services - Time Out. If DRS determines that your refund check was not cashed a stop payment will be placed on the original check and a replacement check will be mailed to you. 450 Columbus Blvd Suite 1 Hartford CT 06103 Phone.

In preparation for this transition the following services will be unavailable from the TSC on the following dates. - Sunset of the single-use plastic bag fee. Your refund cannot be released until our tax investigations staff works with you to confirm your identity.

- Back to Work CT incentive for those returning to the workforce. Whats My 1099-G Amount. We will contact you if any additional information is required.

This is why we have implemented the tax refund protection program. Its taking more than 21 days for us to issue refunds for certain mailed and e-filed 2020 tax returns that require review. Connecticut State Department of Revenue Services.

TSC will accept estimated and in lieu of payments for Corporation Income Pass Through Entity Income Tax Trust Estate Foreign Insurance and Cigarette. This year we have implemented a new tax refund protection program. Please go to Connecticut Taxpayer Service Center to re-login to the system.

Your Connecticut refund status is available via phone. If DRS determines that your refund check was cashed a copy of the cashed check will be mailed to you. 860-297-5962 from anywhere 800-382-9463 within CT outside Greater Hartford area only 860-297-4911 Hearing Impaired TDDTT users only By Email.

800-382-9463 from anywhere or in the Greater Hartford calling area call 1 860-297-5962.

Form W 2 Is One Of The Most Important Documents You Need During Tax Season Employers Must Start Sending Out W 2 Tax Preparation Tax Season Certified Used Cars

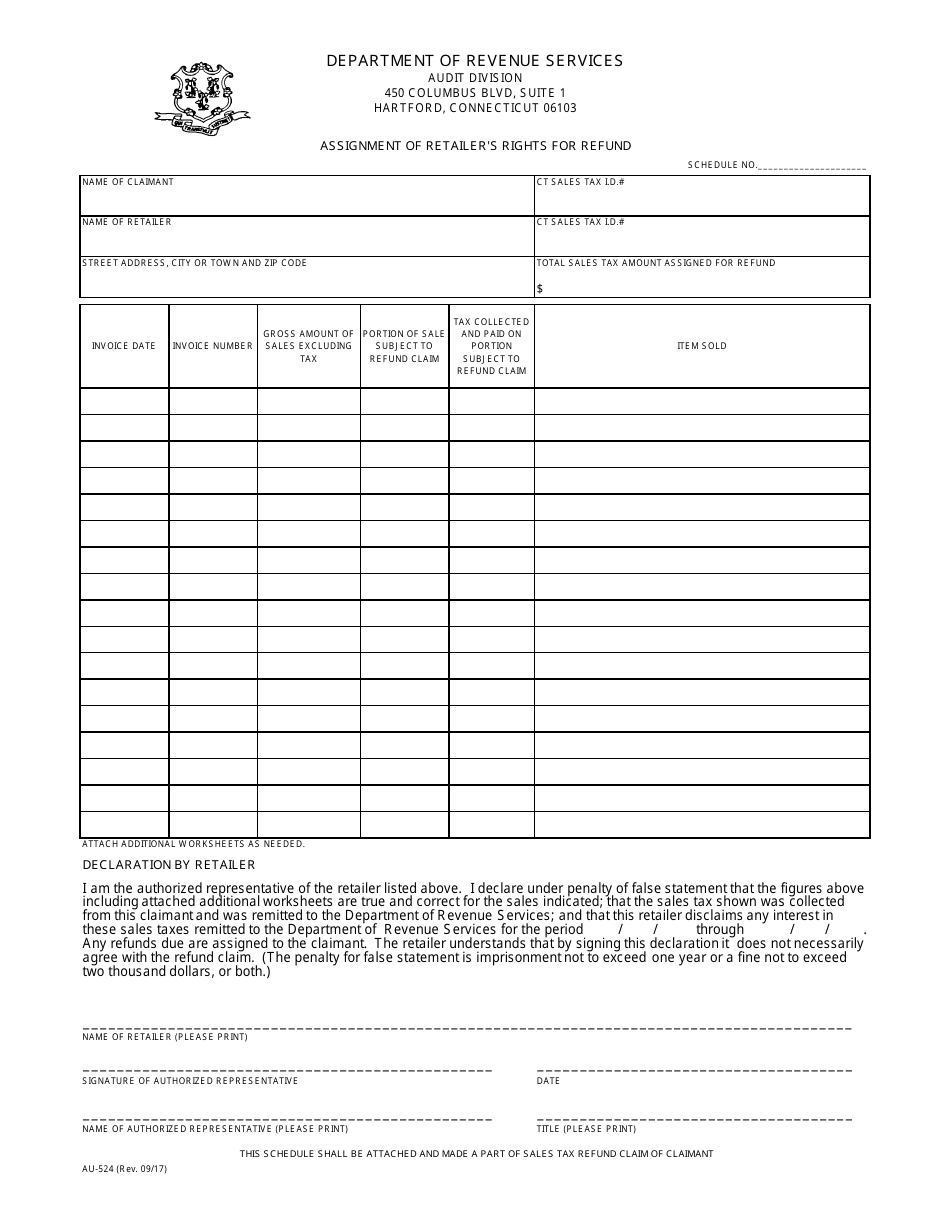

Form Au 524 Download Printable Pdf Or Fill Online Assignment Of Retailer S Rights For Refund Connecticut Templateroller

3 21 3 Individual Income Tax Returns Internal Revenue Service

Pin By Hamza On Tableau3 Termite Control Pest Control How To Plan

Pin On Tax Shop Services Group

Tax Return Tips Can Speed Refund Processing And Help Prevent Theft Of Your Refund Greenwich Free Press Tax Return Theft Prevention Tax

Individual Income Tax Return Help For Everyone When You Do Most Of What You Have At This Time Need To Choose How To Income Tax Return Tax Return Income Tax

Why Tax Refunds Are Taking Longer Than Usual

Tax Returns Due May 17 Last Day To File Taxes Without Penalty Fox61 Com

Connecticut Tax Forms And Instructions For 2020 Ct 1040

File Itr Online With Our Online Software Phone 8750006464 Itr Itronlinie Fileitronline Incometaxreturn Incom Tax Return Income Tax Return File Income Tax

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Where S My Refund Home Facebook

3 17 80 Working And Monitoring Category D Erroneous Refund Cases In Accounting Operations Internal Revenue Service

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer Abc7 New York

Tax Deductions 2017 50 Tax Write Offs You Don T Know About Tax Write Offs Tax Deductions Filing Taxes Married

File Itr Online With Our Online Software Phone 8750006464 Itr Itronlinie Fileitronline Incometaxreturn Incom Tax Return Income Tax Return File Income Tax

Post a Comment for "Ct Revenue Services Refund"