Does Lendingtree Hurt Your Credit

If you receive a loan through LendingClub then a hard credit inquiry that may affect your credit score will appear on your. Having your credit report evaluated is a mandatory and necessary part of the mortgage process Bey said.

If you dont want to risk LendingTree running your credit be stingy with the personal information you give them and do not sign any paperwork.

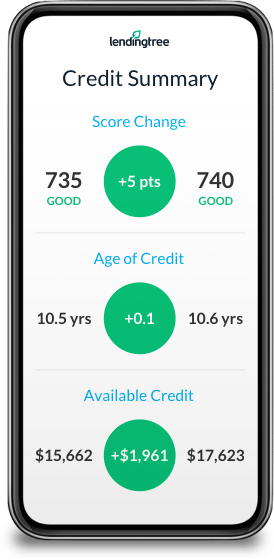

Does lendingtree hurt your credit. Some may pull your credit before they make you a loan offer. And once you sign something and give them access to your personal information you cant stop LendingTree from running your credit. Once you set up an account youll also have access to a free credit score and credit report.

You can check your credit score in a variety of ways knowing it wont hurt your credit by doing so. Debt consolidation doesnt resolve debt on its own so watch your spending habits. For example you can request a free copy of your FICO Score every 30 days through Experian.

Below are five ways debt consolidation could affect your credit score positively or negatively. Just like other loans or credit cards mortgage prequalification doesnt hurt your scores since its also based on a soft inquiry. Because LendingTree only provides loan quotes these requests dont affect your credit score.

By simply filling out a free online application users can get matched with the best personal loan companies. The home buying process the way that banks qualify you and time all work against it. It features enterprises emblem title tackle and contact aspects.

It is a 100 free service that will match applicants to lenders without damaging their credit score. To get loan quotes you first create an account providing your name email address and phone number. Even if LendingTree pulled your credit actually produced the best offers tailored to you in their database of lenders you would not necessarily get that rate when all was said and done.

LendingTrees inquiry does not count towards your credit score nor does it show up on your credit report to anyone but you. Date Thirty day. Debt consolidation could have an impact on your credit score both good and bad.

It generates a soft credit inquiry to provide insight into your creditworthiness. More on that in a minute. Well it is the very important areas it is best to mention inside of your does lendingtree affect credit.

With the questionable disclaimers and caveats listed on LendingTrees website its no doubt LendingTree will likely have similar ones on any paperwork they ask you to fill out and sign. Lendingtree assessment 2017 creditloan. Because of that fact alone there would be no benefit to the bank or anybody involved in the transaction to punish the prospective buyer for having their credit.

When you initially submit an application Lending Tree pulls a copy of your credit report which according to their privacy policy can then be sent to up to 9 Lenders. LendingTree is a good lending option for borrowers that want a quick and easy way to get connected to large authorized lenders. It is this compensation that enables Credit Karma to provide you with services like free access to your credit scores and free monitoring of your credit.

Now as far as points go most peolpe have this entirely. For example transfering credit card debt to a personal loan to free up existing balances might tempt you to spend all over again. Most payday loan lenders wont look at your credit score when deciding whether to give you a loan and they most likely wont alert the nationwide credit reporting companies about it either.

Each Lender has their own policy about pulling your credit. A hard inquiry from a credit card application could hurt your credit and remain on your report even if the card issuer denies your application just like a hard inquiry from a different type of loan or credit line application. However we understand from interviews with members of the Lending Tree network the credit report that is sent with your application does not include all the necessary information a Lender needs to accurately price your loan.

No checking your rate and applying for a loan through LendingClub wont affect your credit score. This is visible only to you not to creditors or others who see your credit report. Each Lender has their own policy about pulling your credit.

In all cases LendingTree pulls your credit. First Lending Tree does not actually lend you the moneythey find banks to let you go to for applications and THEY pull your credit. Header it demonstrates the element details about your organization or Corporation.

Fail to pay it back on time and your lender may take actions that result in lowering your credit. Does lendingtree check your credit yahoo solutions effects. 681Consumers in Their 20sCredit.

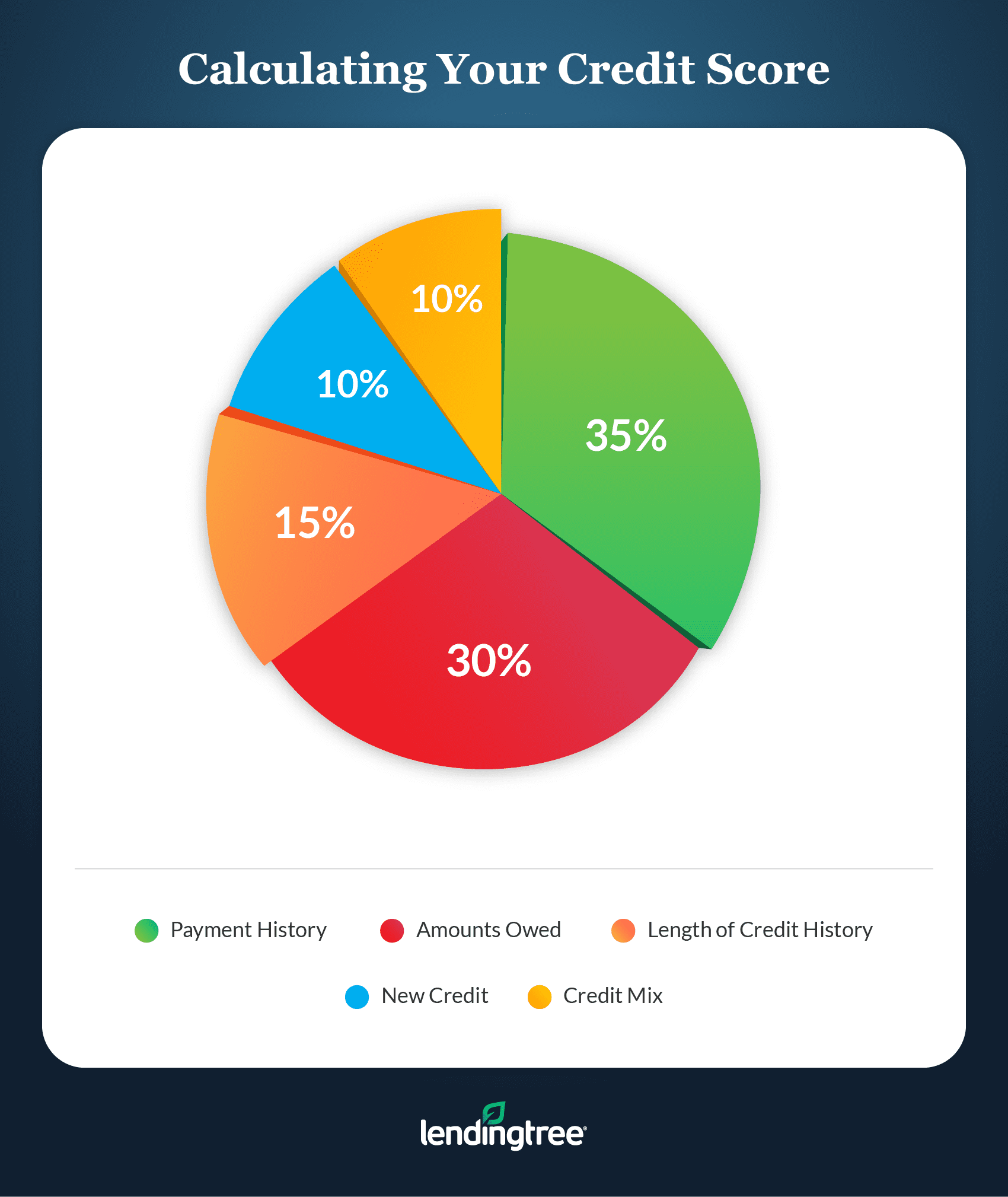

The first thing to note is the affect on your credit score. Lendingtrees inquiry does now not rely in the direction of your credit score score nor does it show up for your credit score. Whats more FICO does not dedupe or buffer out hard inquiries from credit card applications.

Others may pull your credit after you have accepted their offer. Should you produce as personalized you may give your full title tackle and phone details. LendingTrees inquiry does not count towards your credit score nor does it show up on your credit report to anyone but you.

So each Lender will. Does debt consolidation ruin your credit. In all cases LendingTree pulls your credit report when you complete a loan request.

The one exception is auto loan quotes which do affect your credit score slightly. What is the average credit score for a 20 year old. Knowing this you may want to hold off on applying for multiple credit cards at once.

And below the parts are. Lending tree is a free thirdparty provider that fits you with creditors for personal enterprise domestic and car loans as well as credit score cards and refis. In short debt consolidation will only hurt your credit if you let it.

Does LendingTree hurt your credit. LendingTree pulls your credit report when you complete a loan request. But like any unpaid bill loan or credit account failing to pay off a payday loan on schedule can hurt your credit score.

You can also access your free credit score by signing up for LendingTree. This compensation may impact how and where products appear on this site including for example the order in which they appear.

Lendingtree Mortgage Review For 2021 Is It Worth It Simplemoneylyfe

Lendingtree Review Get Loan And Insurance Quotes In Minutes

Lendingtree Reviews Are They Worth It Credible

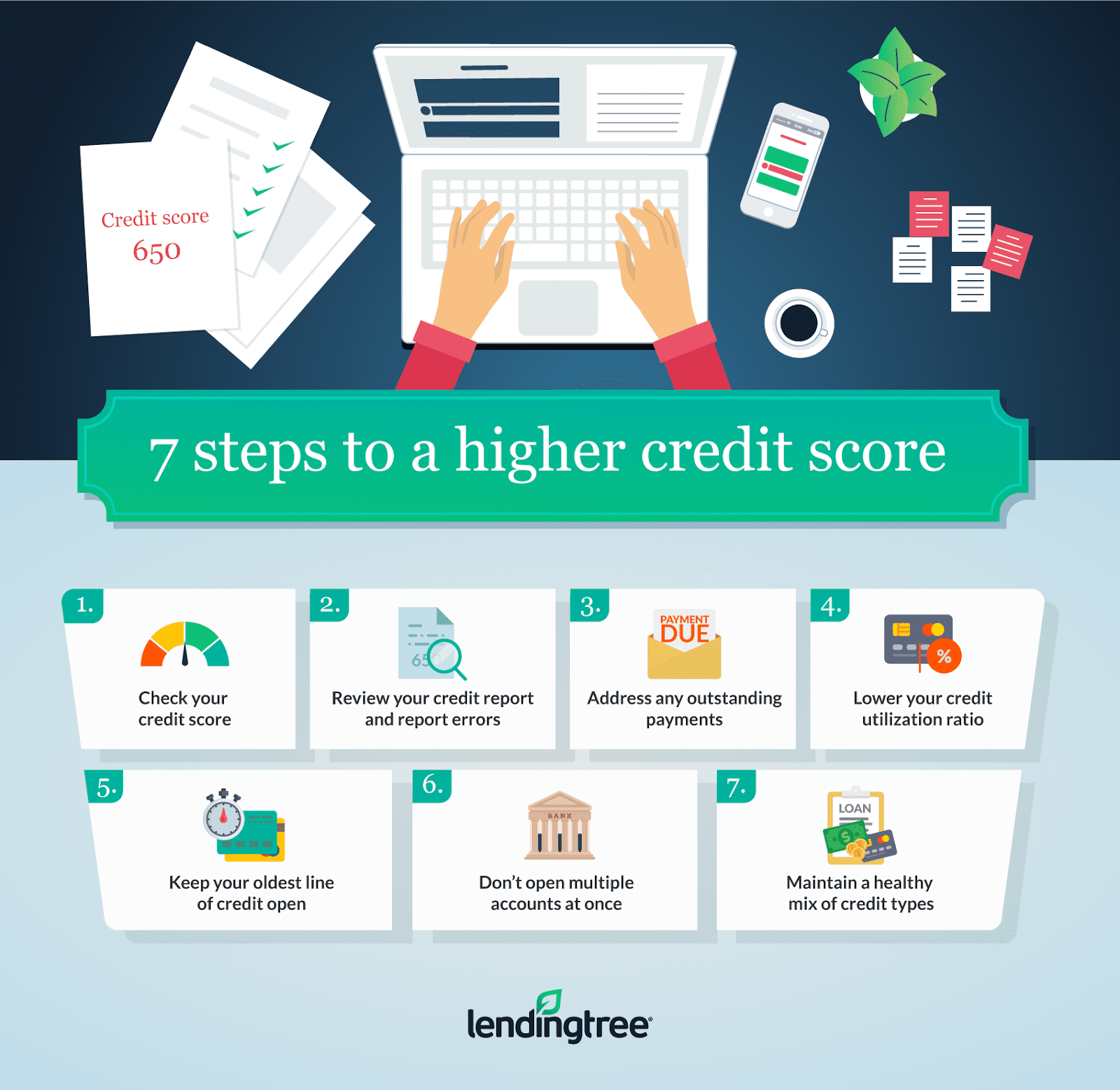

How To Improve Credit Score By 100 Points In 7 Steps Lendingtree

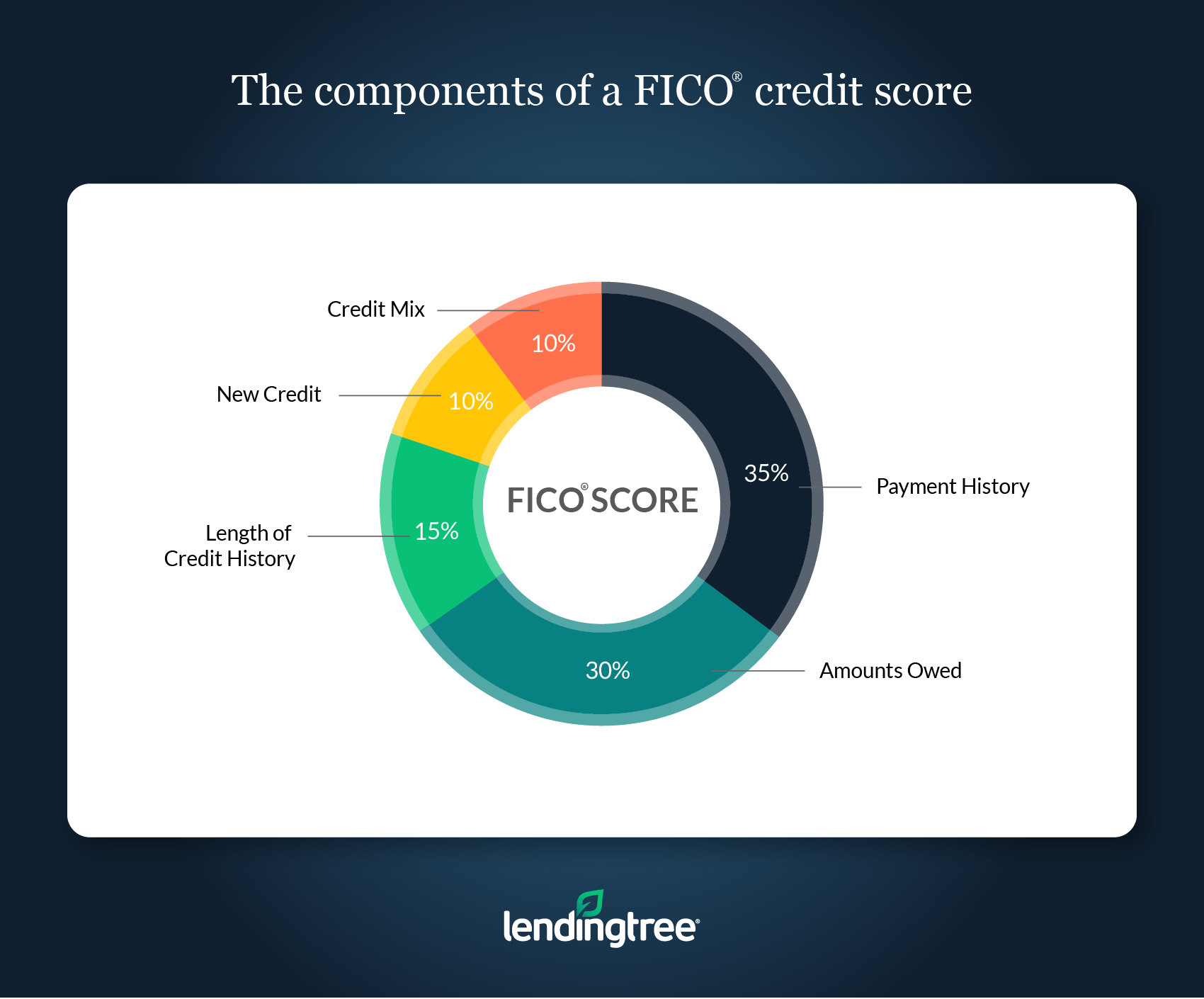

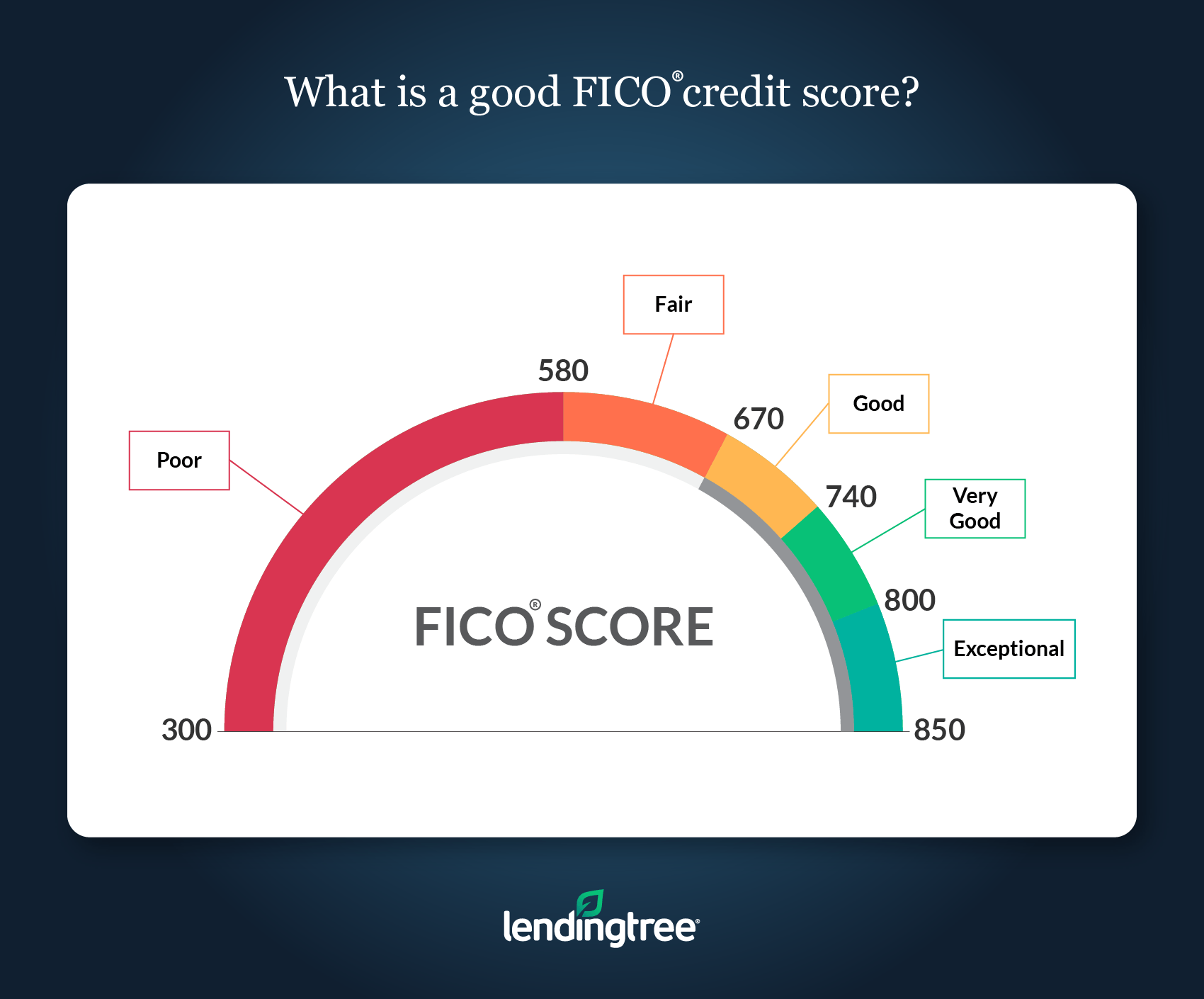

Fico Score Vs Credit Score What S The Difference Lendingtree

Credit Cards First Creditcard Credit Card Tips Kreditkarte Creditcard Creditcards Firs Compare Credit Cards Paying Off Credit Cards Credit Card Payoff Plan

Lendingtree Review Top Ten Reviews

Fico Score Vs Credit Score What S The Difference Lendingtree

Why Pay Exorbitant Interest Rates When You Don T Have To Consolidate Your Credit Car Personal Loans Balance Transfer Credit Cards Consolidate Credit Card Debt

Lendingtree Review Top Ten Reviews

6 Things That Can Hurt Your Credit Score Lendingtree

Lendingtree Auto Loan Review 2020 Good Or Bad Credit Car Financing

Lendingtree Personal Loans Review 2021 Better Credit Blog

Get Your Free Credit Score Lendingtree

Medical Bills Can Hurt Just As Much As The Injury That Caused Them It S Times Like These That You Should Consider A Personal Loan From Le Raznoe Dengi Biznes

Is Lendingtree Legit Safe Lendingtree Trustworthiness Explained First Quarter Finance

![]()

Watch Out For These 7 Lendingtree Problems Protect Your Credit Bestcompany Com

Post a Comment for "Does Lendingtree Hurt Your Credit"